Gold IRA Investing Guide

75Minimum IRA Account: $7,500Eligible Precious Metals: Gold, Silver, Platinum and Palladium. They are responsible for ensuring that the gold investments are compliant with the IRS guidelines and regulations. You will have to contact them before signing up to learn more. IRA amounts of $5,000 to $1,000,000. Birch shares the information and support you need to feel empowered as you diversify your portfolio. Perhaps it’s that intention of customer prioritization that is responsible for so many positive reviews in the first place. The fees and minimum investment amounts charged by gold IRA companies are important to evaluate relative to the services they provide. They offer competitive prices, a wide selection of products, and a secure and safe https://tekelron.com/9-ridiculous-rules-about-gold-ira-review/ environment to store your investments. 9 stars on Google Reviews. You can buy physical precious metals. Moreover, finding the right dealer/vendor is also crucial when investing in physical gold. Investing in a Gold IRA is one of many ways to plan for retirement, and if you choose to do so, you should be aware of the way to do it wisely. Please note that past performance is not a reliable indicator of future results.

:fill(transparent):max_bytes(150000):strip_icc()/AugustaPreciousMetals-0fb8eab0877f414395eb2f49c4bcc455.jpg)

Precious Metals Investing Tips

You can either get the precious metals physically or convert them into cash. Free shipping is available. Attractive gifts with each subscription. They also provide advice on how to diversify your investments and manage your portfolio. Yes, though rollovers have specific rules and not everyone is eligible. Unlock the Power of Precious Metals with Augusta. Noble Gold offers a wide range of services, including a secure storage option and competitive pricing. Precious metals IRA backed by gold or silver. IRA terms of 3 7 years. Since its inception in 2012, this company has strived to educate retirees on how they can protect their money by diversifying their retirement portfolios with gold and silver IRAs.

How does a Gold IRA Work?

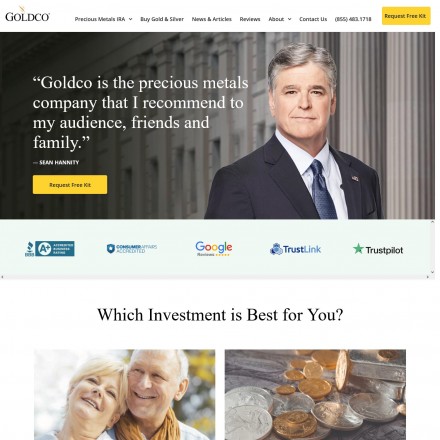

Invest in Your Future with Noble Gold Secure Your Financial Freedom Today. Gold individual retirement accounts IRA are one method of investing in these precious metals. Goldco focuses on making money through investment in the gold market and provides an excellent investment opportunity for those who want to benefit from gold. Goldco’s commitment to simplicity is evident in its IRA services. They follow the IRS rules for gold IRAs and care for their customers. With a knowledgeable and experienced staff, RC Bullion offers reliable customer service and secure storage options for customers’ precious metals investments.

Top 5: Best Gold Investment Companies

We studied their educational materials and their free Gold IRA ebooks and looked for important information regarding their service, Gold IRA fees, and Gold IRA storage. Secure Your Retirement with Advantage Gold’s IRA Options. For centuries, gold has been considered a great store of value that can both reduce the volatility of an investment portfolio and help investors in protecting the purchasing power of their money, as the value of this precious metal tends to appreciate when inflation is rising. Any storage location with IRS approval that the best gold investment companies use will have the security advantages to keep your precious metal investment safe as well as the insurance to protect you against any unforeseen circumstances. GoldCo has an impressive rating due to its excellent customer service, competitive pricing, and wide selection of gold products. Gold IRAs offer significant tax advantages and allow you to diversify your retirement portfolio, with the option to invest in savings accounts backed by gold.

What to Consider Before Investing in a Gold IRA

Noble Gold’s agents will gladly walk you through potential financial solutions with no hard sell or high pressure tactics. You cannot begin trading with retirement dollars until you establish your IRA with Midland. TrustPilot: 5 Stars From 1,124 Reviews. The overwhelming tediousness of the IRA process is a big part of why many people don’t sign up. It’s not a secret that a financial advisor will consider his own interests first when recommending investment options. Smooth process to set up a new precious metals IRA or rollover an existing IRA. The metals are booked into your Entrust account. If you’re interested specifically in a gold or silver IRA account with Birch Gold Group they make it relatively easy to get started funding your retirement source. A minimum investment requirement of $25,000 to open a gold IRA account is currently the second highest investment minimum in the industry. Investors seeking broader diversification can add silver, palladium, and platinum to their gold IRA. Maximize Your Wealth With Augusta Precious Metals. The Texas bullion depository bill HB 483 outlines how depositories can be run in the state. Official members of the Forbes Council. In the case of Goldco, they tout the highest offered prices on buy backs.

Types Of Gold You Can Hold In A Precious Metals IRA

While the general procedure is consistent, slight variations may exist between firms and depositories, so it is prudent to verify the details with one’s chosen service provider beforehand. Metals AvailableGold, silver, platinum, palladiumBBB GradeA+BCA GradeAATrustPilot Review Grade4. It’s possible to alleviate such pitfalls through a diversified investment portfolio. In 1995, Director of the United States Mint Philip N. Celebrity endorsements add to the credibility of the company. Knowing what gold or silver to buy for a precious metal IRA can be challenging, as the IRS only accepts bullion of a certain purity for IRA investment. Other services offered by Noble Gold include storage, which can help investors keep track of their gold and silver purchases easily. This ensures your information is kept confidential and protected from any unauthorized access. These sorts of tactics are unnecessary. It’s a good question to ask. One way a business can distinguish itself from the competition in this market is to prioritize transparency. Your optimal choice is to entrust your assets to a reputable gold IRA custodian.

4 Birch Gold Group

Gold’s account setup is quick and easy and can be completed primarily online. Otherwise, gold IRAs are subject to the same tax benefits, limitations, and withdrawal penalties as traditional IRAs. It’s a proven way to grow your investments. GoldCo offers a full range of services to help customers open and manage their gold and silver IRAs. IRA Nickel Account: 0. Start Your Investment Journey Today. The company has become a popular choice when it comes to precious metal investments because they’re known to go above and beyond when it comes to great customer service. However, there are certain factors investors must consider before deciding on gold IRA companies: fees, track record, customer support, transparency and accountability, among others.

Noble Gold: IRA Accounts Gold Investment Company

Secure Your Retirement with GoldCo: Diversify Your Portfolio with Precious Metals Today. In fact, its value is likely much higher than the face value based on the current price of gold today. Two custodian companies that the Birch Gold Group works with, both having an A+ rating from the Better Business Bureau are STRATA Trust and Equity Trust. Oxford Gold Group provides a variety of gold coins and bars, IRA eligible products, and secure storage options. For gold, that means the purity must be at 99. This makes gold a convenient investment for those who want to have access to their retirement savings. Their expertise in the field is evident in their extensive knowledge of gold investments and their commitment to providing clients with the highest quality service. If you work with an investment adviser, they may charge a fee based on your assets under management. They are a trusted source for gold IRA investments, offering a variety of options to meet the needs of all clients. Oxford Gold Group offers IRS approved coins and bullion, including. Invest better with The Motley Fool. Goldco is a Los Angeles based company that has over a decade of experience in the gold industry.

Oxford Gold Group: Pros – Best Gold IRA Companies

If you’d rather not invest in a gold IRA, you can also purchase gold, silver, platinum, and palladium directly through this company. A gold IRA is a retirement account that holds physical gold, allowing individuals to diversify their retirement savings and protect their wealth. Additionally, our editors do not always review every single company in every industry. It is specialized in asset protection with precious metal investment against financial turmoil. Experience Unparalleled Quality with Augusta Precious Metals Invest in Your Future Today. If you don’t know if your retirement account is eligible for a rollover, simply contact a member of their team, and they will find the answer for you. Birch Gold Group sells gold, silver, platinum, and palladium in coins, bars, and rounds. Going beyond just protecting wealth, Noble Gold’s goal is to put their knowledge and skills towards growing value for customers in a way that’s both kind and honest,. Our Media Gallery gives you access to high resolution images, videos and logos. This kit includes common questions and answers regarding setting up gold IRA’s, as well as the benefits of investing in silver and/or gold. Gold IRA Physical Possession. Putting all your eggs in one basket exposes you to the risk of losing everything. 4 Our Buy Back Guarantee.

Cons:

Additionally, the IRS only allows specific gold coins such as the American Gold Eagle and Canadian Maple Leaf. After the funds have been transferred, the custodian will purchase gold coins or bars on behalf of the investor. Both gold and cryptocurrency are investment assets, but due to its long history, gold has greater utility. Rolling over your 401k into a gold IRA account might be the right move for you, depending on several factors. Discover Oxford Gold’s Luxurious Jewelry Collection and Unlock Your Inner Shine Today. This act expanded the investment options for IRAs beyond paper assets. This program guarantee lets customers sell their precious metals while avoiding additional fees during the liquidation process. Download Gold IRA Guide Now. Invest in Precious Metals with Lear Capital Secure Your Financial Future Today. 2 – choose how you would like to fund it. On the one hand, those who buy frequently and bulk can save money. Adam Baratta and Kirill Zagalsky felt they could bring a higher level of customer support and education to the industry. With gold IRA companies, however, you’ll have a solid alternative to these falling investments.

Where can I find more info about gold and a gold IRA?

Your specialist will handle all the details and will get confirmation from you before anything is purchased. Spread betting spreads. Also, by opening a Gold IRA you can take advantage of an annual contribution of $6,000 if you are below 50 years old and $7,000 if you are above 50 years old. Get Expert Guidance for Your Gold Investments with American Hartford Gold Group Start Building Your Wealth Now. Birch Gold Group: Best storage options. In short, those considering adding a gold or silver IRA to their retirement portfolios should strongly consider taking advantage of what Noble Gold Investment has to offer.

About the company

You can also set up a brand new precious metals IRA, if you don’t have an existing retirement account to transfer funds from. Patriot Gold Group has a relatively transparent pricing structure, with a flat setup fee for new precious metal IRAs. Depending on the Custodian, storage fees can range from $10 to $60 per month, or as a percentage of assets, from 0. Each customer gets a personal representative to provide assistance with self directed IRA setup and gold IRA rollovers. BBB: A+ From 441 Reviews. As you can imagine, investing in physical gold comes with its challenges. Oxford Gold Group is a resource for precious metals collectors as well as investors. They focus on serving the individual retirement account IRA market for gold and silver. When you own stocks and bonds in an IRA, if your account is self directed, it is entirely possible your commissions will be free or close to it, depending on where your account is custodied.

PROS:

They provide a secure and reliable platform for their customers, as well as a knowledgeable team of professionals who are always available to answer any questions. Invest in Precious Metals with Lear Capital Secure Your Financial Future Today. In addition, they need to be in excellent condition. Furthermore, Lear Capital has a variety of gold IRA options, making it easy for customers to find the perfect fit for their individual needs. Fortunately, it’s as if he was reading my mind. Augusta Precious Metals also offers a variety of services for investors looking to add physical gold to their retirement accounts. In addition, Noble Gold is accredited by the Better Business Bureau BBB and has been awarded an A+ rating, demonstrating its commitment to customer satisfaction and ethical business practices. Overall, GoldBroker is one of the best gold IRA companies, offering investors a safe and secure way to invest in gold and silver. These golden companies have a solid reputation to back up their star power. This structure may work in your favor if you have a high account balance. Gold IRA companies offer investors the opportunity to diversify their retirement portfolios by investing in precious metals such as gold, silver, platinum, and palladium. With a team of experienced professionals, Augusta Precious Metals is the best gold IRA custodian for those looking to invest in gold.

The Pros and Cons of Investing in a Gold and Silver IRA

Augusta also has good marks given by the Better Business Bureau, as well as the Business Consumer Alliance. It is important to carefully review the terms and conditions of any loan agreement before signing, to ensure that you fully understand the terms of the loan and are comfortable with the repayment schedule. Noble Gold’s commitment to truth and kindness starts at the top with the friends who founded the firm. Firstly, they have gained an outstanding reputation with their customers and industry watchdog organizations since their inception in 2012. While it may have a steep minimum investment, the services provided by the company make it a great choice if you value transparency and learning while you invest. Despite these potential downsides, Gold IRAs can still be a valuable component of a diversified investment portfolio. Put the informational materials and firm knowledge to work for you. If you fail to sell within 2 months, you will have to deal with tax penalties. If you’re worried about scams within the gold IRA investing industry, watch this video to understand the process.

Colin Shipp

This buyer’s guide overviews the best gold IRA companies for 2023. The company has an A+ rating from the Better Business Bureau, five stars from TrustLink and 4. This money covers the costs of opening your precious metals account, holding your items in a safe place, and maintaining your account over time. CreditDonkey does not know your individual circumstances and provides information for general educational purposes only. Noble Gold Investments, a leading precious metals IRA firm, is rapidly growing. You’ll be able to start small and add on over time. Answer: You can use a precious metal IRA to hold gold coins, bars, and bullions along with other metals like silver, platinum, and palladium. Team of experienced professionals to assist with investments. The best gold IRA companies have years of experience in setting up gold individual retirement accounts. Limited availability in some locations. Augusta works with depositories throughout the United States, including Springfield Gardens, New York, Jackson, Ohio, and Salt Lake City, Utah. Discover how Augusta Precious Metals can help you safeguard your financial future with its gold and silver IRA solutions. The core values of knowledge, one on one care, and trust enhance all of the company’s interactions and services.

Learn More

Own precious metals: Once your gold IRA rollover is complete, you can choose the precious metal coins, bars, and bullion to include in your investment. Augusta Precious Metals has gained recognition for its gold and silver IRA products, with an emphasis on gold IRA investments. They also offer many educational resources that will help you make informed decisions. Invest in Your Future with Patriot Gold Club Our Top Choice for IRA Precious Metals. If you aren’t sure of all the answers, the company can call you to guide you through the process of finding the necessary information. This means that your investments can grow without being taxed for several decades or longer. Lear’s knowledge of the gold and silver markets is established in the private markets and translates well to their IRA management.

5 Easy steps:

Which gold firms are the industry leaders. That’s why we’ve taken the time to carefully evaluate and compare the top rated gold investment companies in the industry. Plan for the inevitable and protect your retirement savings with a gold backed IRA from Noble Gold Investments. Competitive wholesale pricing. Before investing in a gold IRA, thoroughly research the company and ensure that it meets all the requirements for an IRA and adheres to all relevant regulations. You can start a precious metals IRA with Red Rock Secured and invest in gold, silver coins, and other items. Investors should research the custodian’s licenses, insurance, and storage options, and compare fees, storage options, and customer service before deciding. The American Hartford Gold Group specializes in gold IRA investments, as well as providing a variety of other services related to gold. IRA Term Options: 3, 5, 7, 10 and 20 years. 2 How to Invest in Gold or Silver. They offer a wide range of IRA gold investment products, from gold coins to gold bars, allowing customers to diversify their portfolios. American Hartford Gold is one of the most reputable gold IRA companies in the industry, with 5 star customer satisfaction ratings on multiple review platforms, including Trustpilot and Google.

Disclaimer

But that’s not all hundreds of happy customers have given them five star reviews, so you can be confident in their practices. Investors buy gold to hedge against risks such as rising inflation, geopolitical events, and financial crises. => Visit Birch Gold Group Website. I agree to receive news, updates, and other communications from Sandstorm Gold Ltd. They’ll not only explain the intricacies of working with this company but also educate you about precious metal IRAs. The name “gold IRA” doesn’t mean that only gold is allowed in the account. Bullion Directory ranked them the 1 gold bullion dealer of the year for both 2017 and 2018. Withdrawals before the age of 59 and a half may be subject to a 10% early withdrawal penalty. It’s important to carefully review and understand all fees before choosing a gold IRA custodian. To help you get started, we have outlined the three primary steps involved in opening and running an account with them. Discover the Benefits of GoldCo: Experience Top Notch Service Today. Experienced and qualified team of professionals. A Gold IRA Rollover is a process of transferring retirement funds from a traditional IRA or 401k plan into a precious metals IRA.