Many applicants have reported the IRS lost their passports or other valuable and hard-to-replace identification documents. Consider getting certified copies or using one of the application methods listed below, rather than mailing original identification documents to the IRS. To obtain an ITIN, you must complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number. The Form W-7 requires documentation substantiating foreign/alien status and true identity for each individual.

This will prevent you from having to mail your proof of identity and foreign status documents. For people who want to be granted US citizenship or permanent legal residence, filing a tax return is an important first step in demonstrating your “moral character” to the government. And acquiring an ITIN allows anyone — including nonresidents and undocumented immigrants — to file and pay their taxes.

How do I apply for an ITIN?

An Employer Identification what is the journal entry for when a business makes a loan Number (EIN) is also known as a federal tax identification number, and is used to identify a business entity. It is also used by estates and trusts which have income which is required to be reported on Form 1041, U.S. Refer to Employer ID Numbers for more information.The following form is available only to employers located in Puerto Rico, Solicitud de Número de Identificación Patronal (EIN) SS-4PR PDF. An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service. The best option is to file your tax return as early in the tax filing season as possible. If you decide to work with a CAA, they can verify your original documents and send certified copies to the IRS for you.

Option 2

- However, you won’t get any of that money back in the form of future benefits — unless, of course, you acquire a Social Security number down the road.

- A taxpayer who was experiencing a family emergency and needed to travel out of the country with his…

- Acceptance Agents (AAs) and Certifying Acceptance Agents (CAAs) can help you complete applications.

- If you qualify for an exception, then file Form W-7 with your proof of identity and foreign status documents and supporting documentation for the exception.

- If you would like a tax expert to clarify it for you, feel free to sign up for Keeper.

- Low Income Taxpayer Clinics (LITCs) are independent from the IRS and TAS.

If you aren’t claiming them on your tax return, there’s no reason for them to get an ITIN number. Anyone who needs to pay taxes but doesn’t fit into the Social Security box should get an ITIN. If you do not want to apply for a PTIN online, use Form W-12, IRS Paid Preparer Tax Identification Number Application. You will receive a letter from the IRS assigning your tax identification number usually within seven weeks if you qualify for an ITIN and your application is complete. If you miss the 45-day window, your application will be automatically rejected. You can use the phone number listed on the notice to call with any questions.

Individual taxpayer identification number (ITIN) reminders for tax professionals

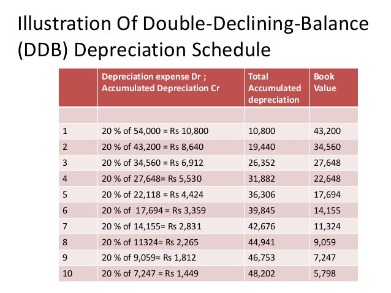

As an independent organization within the IRS, the Taxpayer Advocate Service helps taxpayers resolve problems and recommends changes that will prevent problems. The discussion of allowable straight line depreciation calculator tax benefits has been expanded. For more information see Allowable Tax Benefits in the Instructions for Form W-7 PDF. Last but not least, be sure to sign and date your W-7 at the bottom, and provide a good phone number for the IRS to reach you at, just in case. Not every section will apply to you, and it’s okay to skip those parts.

How to apply for an ITIN

IRS issues ITINs to help individuals comply with the U.S. tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security numbers. They are issued regardless of immigration status, because both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code. ITINs do not serve any purpose other than federal tax reporting. You can file Form W-7, Application for IRS Individual Taxpayer Identification Number (ITIN), with your federal income tax return. You must also include original documentation or certified copies from the issuing agency to prove identity and foreign status.

This allows you to avoid mailing your original documents, or certified copies, to the IRS. A certified copy is one that the original issuing agency provides, and certifies as an exact copy of the original, and contains an official stamped seal from the agency. Certifying Acceptance Agents and many Taxpayer Assistance Centers, discussed below, may also certify certain documents. If you are submitting any documentation to IRS which includes a copy of a prior submitted tax return, please make sure that COPY is written in large letters across the top of the tax return. This will ensure the tax return is not processed again as an original. An ITIN may be assigned to an alien dependent from Canada or Mexico if that dependent qualifies a taxpayer for a child or dependent care credit (claimed on Form 2441).

To apply for an understanding a bank’s balance sheet ITIN, complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number. Form W-7 requires documentation substantiating foreign/alien status and true identity for each individual. They don’t entitle the taxpayer to Social Security benefits, stimulus payments, or other benefits. If you’re required to file a tax return and aren’t eligible for a Social Security number, you need to apply for an ITIN (See the What should I do? section, above). Applicants who meet one of the exceptions to the requirement to file a tax return (see the Instructions for Form W-7) must provide documentation to support the exception.

Acceptance Agents (AAs) and Certifying Acceptance Agents (CAAs) can help you complete applications. Each of these groups has specific requirements to qualify. See IRS.gov – ITIN Updated Procedures Frequently Asked Questions. Ask a real person any government-related question for free.

Individual Tax ID Numbers, on the other hand, are issued by the IRS and can’t be shared with other departments “The IRS… does not provide USCIS with tax information for immigration enforcement purposes,” Castro says. Acceptance Agents are entities (colleges, financial institutions, accounting firms, etc.) who are authorized by the IRS to assist applicants in obtaining ITINs. They review the applicant’s documentation and forward the completed Form W-7 to IRS for processing. You will need to complete Form SS-5, Application for a Social Security Card PDF. You also must submit evidence of your identity, age, and U.S. citizenship or lawful alien status.