The interest coverage ratio is one of the most important ratios for investors and creditors alike. A high interest coverage ratio means that the company has more than enough cash flow to make its debt payments. This is a sign of a healthy company with a low risk of defaulting on its debt. A low interest coverage ratio, on the other hand, means that the company may not be able to make its debt payments, which could lead to a default. For investors looking to make informed investment decisions, the ICR can be a valuable tool for assessing the financial health of a company. By comparing a company’s ICR to industry benchmarks and historical data, investors can gain insight into the company’s ability to service its debt obligations and generate future cash flows.

Fitch Affirms Lazard Group at ‘BBB+’; Outlook Stable – Fitch Ratings

Fitch Affirms Lazard Group at ‘BBB+’; Outlook Stable.

Posted: Fri, 01 Sep 2023 20:16:00 GMT [source]

Interest and taxes are are listed as expenses on your profit and loss statement. While this debt isn’t a bad thing in business, too much of it can eat into your profits. That’s why knowing how easily you can use your earnings to pay off existing loans is essential, and that’s where the interest coverage ratio comes into play. While there is no “perfect” ICR for every business, it is generally considered that an ICR of 2 or higher is ideal. This means that the company has earnings that are at least twice its interest expenses, which provides a comfortable buffer for unforeseen events or economic downturns. It is unlikely that Walmart would be unable to cover its current interest expense with its operating income.

The term “interest coverage ratio” originated in finance and is used to evaluate a company’s ability to pay its interest expenses on outstanding debt. It is a commonly used financial metric that has been in use for many decades. Another potential interest coverage ratio formula you can use applies EBIAT (earnings before interest after taxes) instead of EBIT. This is a much more stringent ratio and provides you with the best insight into your company’s ability to cover its interest expenses.

If its operating income is $120,000, it has an interest coverage ratio of 12x. This is a positive sign that the company will have no problems covering its interest expenses with its operating income. The interest coverage ratio is easy to calculate because its components are readily identifiable. Operating income and interest expense can both be found on a company’s income statement.

Interest Coverage Ratio Interpretation

It is important to note that ICR is not the only metric that should be considered when analyzing a company’s financial health. Other factors such as cash flow, profitability, and debt levels should also be taken into account. However, ICR can provide valuable insight into a company’s ability to manage its debt and meet its financial obligations. However, a high ratio may also indicate that a company is overlooking opportunities to magnify their earnings through leverage. As a rule of thumb, an ICR above 2 would be barely acceptable for companies with consistent revenues and cash flows.

The interest coverage ratio is important because it provides a snapshot of a company’s ability to make its current interest payments. This metric is used by creditors and lenders to assess the risk of lending capital to a company. Many metrics can help you determine the financial health and well-being of companies state and local tax deduction, salt, for 2019, 2020 returns and, therefore, your investment portfolio. Knowing how to calculate it and using it with other valuable financial metrics can help you become a well-informed investor so you can make better decisions about your investments. A company’s interest coverage ratio is an indicator of its financial health and well-being.

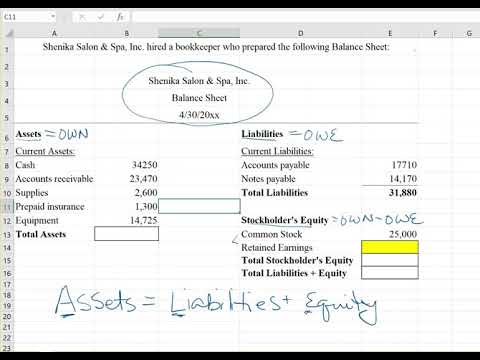

Interest Coverage Ratio Calculator

The company achieved revenue of $35.5 million in 2018, while it incurred raw material and direct labor costs of $12.2 million and $5.5 million, respectively. The rental expense, depreciation, and salaries for the period are $0.7 million, $1.5 million, and $3.7 million, respectively. Calculate the company’s interest coverage ratio if its annual interest expense was $2.2 million. A higher ICR indicates that a company is more capable of paying interest on its debt.

A high ratio indicates there are enough profits available to service the debt. For example, if a company is not borrowing enough, it may not be investing in new products and technologies to stay ahead of the competition in the long term. If a company has a low-interest coverage ratio, there’s a greater chance the company won’t be able to service its debt, putting it at risk of bankruptcy. A low-interest coverage ratio means there is a low amount of profit available to meet the interest expense on the debt. Also, if the company has variable-rate debt, the interest expense will rise in a rising interest-rate environment.

As a result, the quality of the interest coverage ratio is directly related to the quality of the accounting information used to calculate it. This blog will delve into the basics of the interest coverage ratio and why it’s such an important metric. From how it’s calculated to its significance in financial analysis, you’ll walk away with a comprehensive understanding of the interest coverage ratio. In other words, it measures how well a company can cover the interest payment on its debt.

Real Company Example: Walmart’s Interest Coverage Ratio

You can use the interest coverage ratio calculator below to quickly calculate how easily your company can make your current interest payments by entering the required numbers. In the calculation, EBIT is used rather than net income to provide the most accurate picture of what the company can afford to pay in interest. Using net income would mess up the calculation as interest expense would then end up counted twice and tax cost would adjust according to the deducted interest.

Decoding the Future of Dominion Energy Inc (D): A Deep Dive into … – GuruFocus.com

Decoding the Future of Dominion Energy Inc (D): A Deep Dive into ….

Posted: Tue, 05 Sep 2023 16:05:09 GMT [source]

In simpler terms, it represents how many times the company can pay its obligations using its earnings. The interest coverage ratio (ICR) is a measure of a company’s ability to service its debt. It is calculated by dividing a company’s earnings before interest and taxes (EBIT) by its interest expenses. The debt coverage ratio (DCR) is a measure of a company’s ability to service its debt. It is calculated by dividing a company’s cash flow from operations by its debt payments.

Understanding the interest coverage ratio

In general, however, it’s preferable to have EBIT well in excess of interest in order to provide a cushion in case anything goes wrong. That said, there may be a limit to how high of an interest coverage ratio is appropriate for a company as well. Firms can often benefit from using debt to invest in new growth opportunities. It could be counterproductive for a firm to pay off debt and thus raise its interest coverage ratio if doing so would cause it forego highly profitable investments while it reduces its debt load.

The general rule is that the higher the ratio, the better position a company has to repay its interest obligations while lower ratios point to financial instability. Analysts generally look for ratios of at least two (2) while three (3) or more is preferred. The interest coverage ratio is not a perfect measure of a company’s financial health. For example, a company can have a high ratio but still be in trouble if it cannot generate enough cash flow to cover its debt payments. However, the interest coverage ratio is a useful tool for banks and other financiers to use when evaluating a company’s ability to pay its debts.

Other important metrics include debt-to-equity ratio, current ratio, and return on equity. By analyzing these metrics together, investors and creditors can get a more comprehensive understanding of a company’s financial health and make more informed investment and lending decisions. ICR is an important financial metric that is used by investors and creditors to assess a company’s financial health. A high ICR indicates that a company is generating enough earnings to cover its interest expenses, which is a positive sign for investors and creditors. On the other hand, a low ICR indicates that a company may be struggling to meet its interest payment obligations, which could be a red flag for investors and creditors. Operating income is sometimes referred to as earnings before interest and taxes (EBIT).

- Annual calculations help evaluate a company’s financial performance over a longer period and for making comparisons with other companies.

- For example, if a company is not borrowing enough, it may not be investing in new products and technologies to stay ahead of the competition in the long term.

- Another factor that can affect a company’s ICR is the interest rate environment.

- Forgoing an investment, for example, that would pay 15% a year returns simply to improve a company’s interest coverage ratio would likely be suboptimal for shareholders.

This includes proper recognition and measurement of revenue, expenses, and liabilities and proper disclosure of any accounting policies and assumptions used in preparing the financial statements. First, the metric is only a snapshot in time and does not necessarily reflect a company’s long-term ability to repay debt. Additionally, ICR does not take into account a company’s capital structure, which can affect its ability to repay debt. Regardless of the type of calculation you run, another important consideration is that interest coverage varies tremendously by industry, and even between companies.

Interest Coverage Ratio Example

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. By the end of Year 5, EBITDA is growing at 12.0% year-over-year (YoY), EBIT is growing by 9.5%, and Capex is growing at 13.0%, which shows how the company’s operations are growing. Therefore, the higher the number of “turns” for an interest coverage ratio, the more coverage (and reduced risk), because there is more “cushion” in case the company underperforms. The more debt principal that a company has on its balance sheet, the more interest expense the company will owe to its lenders — all else being equal. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Too low of an interest coverage ratio can signify that a company may be in peril if its earnings or economic conditions worsen. Interest coverage ratio is a metric used to determine whether a company can meet its financial obligations. Potential lenders or investors can use the interest coverage ratio when deciding whether to give you new lines of credit. The higher the ratio, the better because it means you have enough money to pay for your current loans comfortably. This ratio can also be considered a debt or profit ratio or the times interest earned (TIE) ratio, which we’ll dive into later on.