Efficiency ratios measure a business’s ability to manage assets and liabilities in the short-term. A higher accounts receivable turnover ratio indicates that your company collects funds from customers more often throughout the year. On the flip side, a lower turnover ratio may indicate an opportunity to collect outstanding receivables to improve your cash flow. The accounts receivable turnover ratio is one metric to watch closely as it measures how effectively a company is handling collections.

How to Calculate Accounts Receivable Turnover

Therefore, it takes this business’s customers an average of 11.5 days to pay their bills. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which will meghan markle and prince harry’s second child have dual citizenship 11 Financial maintains a registration filing. This way, businesses will have more capital at disposal which can then be used for other purposes like expansion or even debt repayment if necessary without affecting business operations.

Top-Rated Accounting Platforms for Midsize Businesses in 2024

- With Bench at your side, you’ll have the meticulous books, financial statements, and data you’ll need to play the long game with your business.

- By learning how quickly your average debts are paid, you can try to determine what your cash flow will look like in the coming months in order to better plan your expenses.

- And with a few solid years under your belt, your small business is ready to take the world by storm.

- A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

- First, it enables companies to understand how quickly payments are collected so they can pay their own bills and strategically plan future investments.

In effect, the amount of real cash on hand is reduced, meaning there is less cash available to the company for reinvesting into operations and spending on future growth. Though we’ve discussed how this metric can be helpful in assessing how long it takes your business to collect on credit, you’ll also want to remember that just like any metric, it has its limitations. On this balance sheet excerpt, you can see where you would pull the accounts receivable number from. This can lead to a shortage in cash flow but it also means that if the business simply hired more workers, it would grow at exponential rates.

Limitations of the Accounts Receivables Turnover Ratio

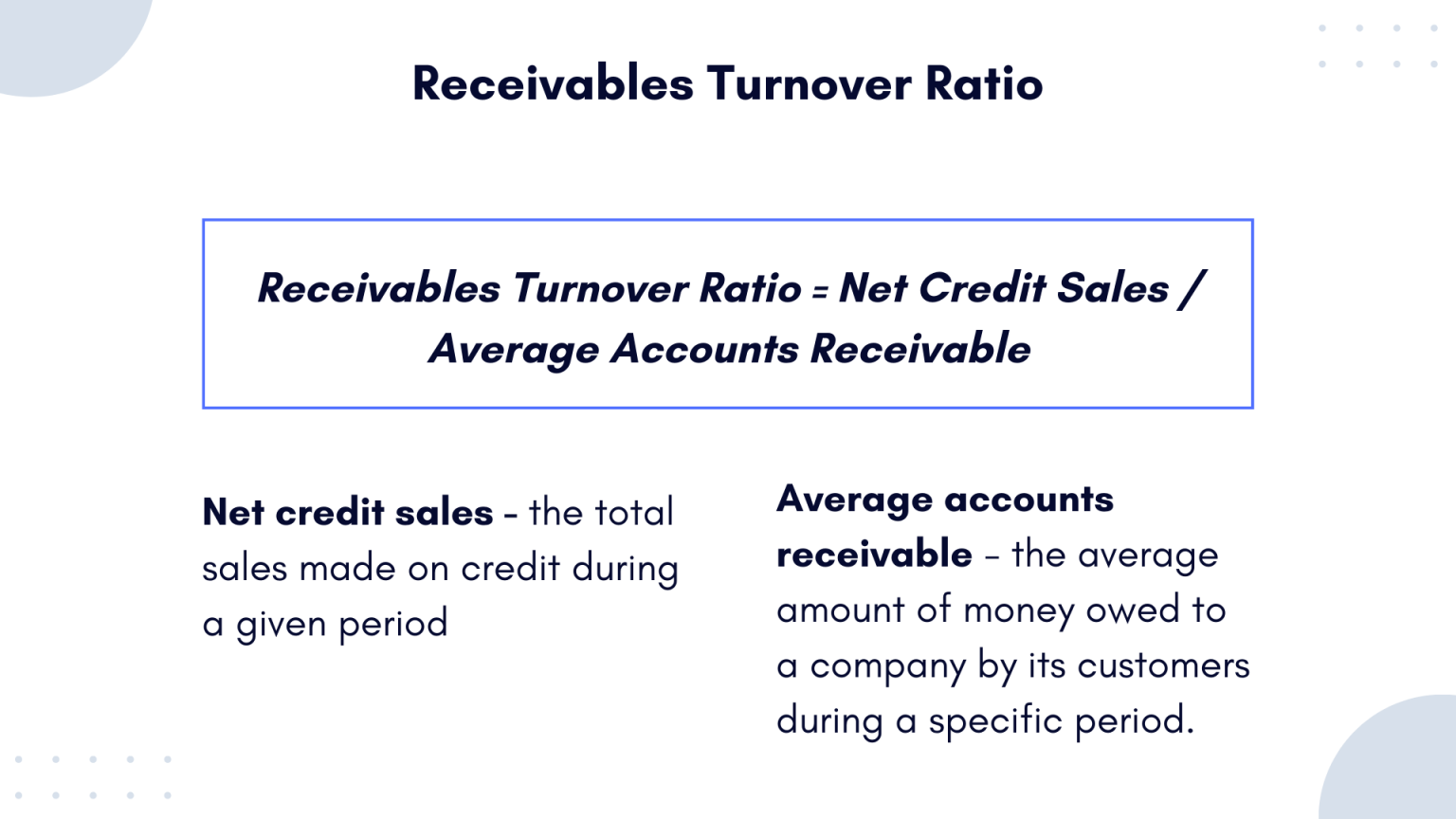

A high accounts receivables turnover ratio can indicate that the company is conservative about extending credit to customers and is efficient or aggressive with its collection practices. It can also mean the company’s customers are of high quality, and/or it runs on a cash basis. The numerator of the accounts receivable turnover ratio is net credit sales, the amount of revenue earned by a company paid via credit. This figure does not include cash sales as cash sales do not incur accounts receivable activity. Net credit sales also incorporates sales discounts or returns from customers and is calculated as gross credit sales less these residual reductions. A lower ratio means you have lots of working capital tied up in outstanding receivables.

Understanding Receivables Turnover Ratios

Discover the next generation of strategies and solutions to streamline, simplify, and transform finance operations. Learn the right way to pay yourself, depending on your business structure. When you know where your business stands, you can invest your time in solving the problem—or getting even better. Since industries can differ from each other rather significantly, Alpha Lumber should only compare itself to other lumber companies. For small business owners like you, succeeding goes beyond simply surviving. And with a few solid years under your belt, your small business is ready to take the world by storm.

A company should regularly review and adjust its credit policies to reflect the financial landscape and the risk profile of its customers. Some companies use total sales instead of net sales when calculating their turnover ratio. This inaccuracy skews results as it makes a company’s calculation look higher. When evaluating an externally-calculated ratio, ensure you understand how the ratio was calculated. The receivables turnover ratio is just like any other metric that tries to gauge the efficiency of a business in that it comes with certain limitations that are important for any investor to consider. A high asset turnover ratio indicates effective asset utilization, which often translates to higher profitability.

Secondly, the ratio enables companies to determine if their credit policies and processes support good cash flow and continued business growth—or not. A bigger number can also point to better cash flow and a stronger balance sheet or income statement, balanced asset turnover and even stronger credit worthiness for your company. The accounts receivable turnover ratio, also known as the debtors turnover ratio, indicates the effectiveness of a company’s credit control system.

Like other financial ratios, the accounts receivable turnover ratio is most useful when compared across time periods or different companies. For example, a company may compare the receivables turnover ratios of companies that operate within the same industry. In this example, a company can better understand whether the processing of its credit sales are in line with competitors or whether they are lagging behind its competition.